Probability

Scientific consent is that the possibility of a bird flu pandemic is a serious concern. The world has been preparing for a bird flu pandemic for more than 20 years. Now a mutated virus is spreading all over the globe, with a non-zero chance of causing a severe pandemic.

Most people refuse to consider another pandemic as a possible reality. But what if we do think about a specific scenario, not just some vague idea? An H5N1 pandemic in the next 12 months? How likely is that in percent?

Assigning any specific probability above zero makes you think. Wouldn't 10% be too pessimistic? How about 1%? What if you had to bet money on it? Some people do bet on it and end up with very roughly 10% for 12 months. We can be a bit more optimistic and assume 5%. Just for the next 12 months, compatible with the idea that the outbreak will subside sooner or later, and compatible with this interesting analysis of prediction markets. Quantifying the probability is essential to acknowledge H5N1 as a real and manageable financial risk.

In the 2022 British National Risk Register the chance of any pandemic happening in the next 5 years is estimated to be in the 5-25% range. One statistical approach results in a 3% annual chance of a "mild" pandemic as in 2009, 1% for a pandemic of "medium" severity and only a 0.02% chance of a pandemic as severe as the 1918 pandemic. One estimate from 2019 of the probability of an H5N1 pandemic resulted in 5% in 10 years, based on occasional bird-to-human transmissions, just before the emergence of H5N1 clade 2.3.4.4b with frequent infections of mammals. Another statistical approach results in a 2.5-3.3% annual chance of a pandemic as lethal as Covid-19 or worse. However, this is an unprecedented situation and not an average year. While there are good news too, the overall situation keeps getting worse. Historical data about the sporadic influenza pandemics every few decades is of limited use and the current spread of H5N1 is not sustainable in the long term. What matters is the situation today and the risk for the next few years.

Impact

A bird flu or "Highly Pathogenic Avian Influenza A(H5N1)" pandemic would differ from the Covid-19 pandemic. While H5N1 would probably be a lot less transmissible, it could also be much more lethal with a case fatality ratio in the double-digits. Masks would drastically reduce the personal health risks. However, public health measures have been politicized and may be ineffective. Once again there could be a massive economical impact.

With the experience from the Covid-19 pandemic, what would be the impact of an H5N1 pandemic for you, personally? Unemployment, loss of savings and investments, discontinuation of business, supply chain issues, mobility restrictions, physical and mental health issues, scarcity of goods? In any case there may be financial consequences, directly or indirectly.

Your Personal Risk

Everyone has a different personal risk, risk tolerance, and financial goals. You have to determine probability and impact for yourself. However, it should be clear that even a seemingly small probability like 5% annually of a serious financial impact should be taken seriously. Typically you do that by paying for insurance against low probability risks like accidents or water damage.

Risk Management

On a larger scale a pandemic is not insurable. Any insurance company would have to pay too much all at once. But as an individual you can invest in bird flu stocks.

However, those stocks are not as directly related to a pandemic event as an insurance contract would be. There is also no company that is entirely focused on an avian influenza pandemic. Pharmaceutical stocks tend to be volatile and additional risks include for example failure of pharmaceutical studies or patent litigation. Stocks with a smaller market capitalization tend to represent greater opportunities but also even higher risk.

Estimates regarding study completion and FDA approval vary depending on data set and methodology. In this detailed analysis chances to continue from a phase 1 study to FDA approval are 33% for vaccines and 25% for infectious disease treatment. For a phase 2 study the chances are 42% and 35%. For a phase 3 study the chances are 85% and 75%.

A small investment in bird flu stocks may mitigate the financial risks of an influenza pandemic.

Financial Potential

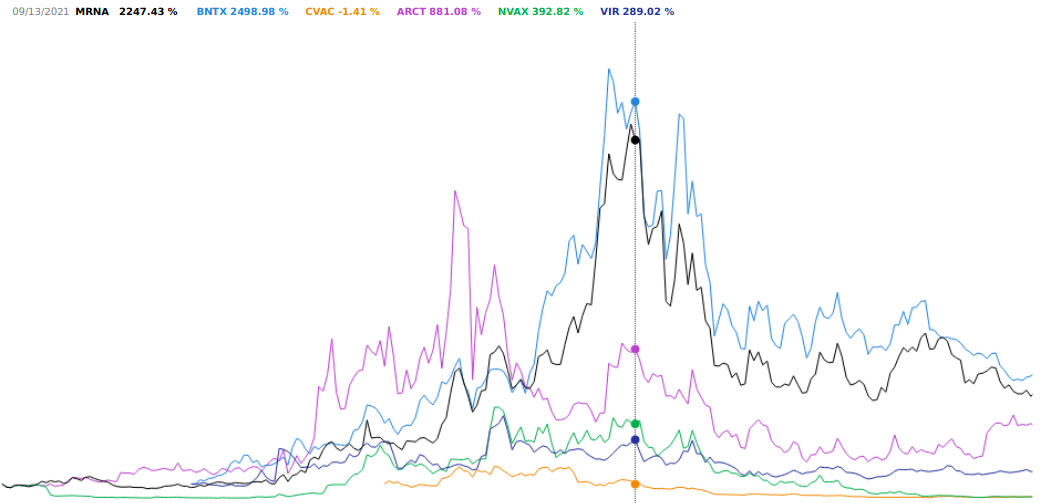

During the Covid-19 pandemic a small number of pharmaceutical stocks rose dramatically in value. The focus was on the new mRNA technology and vaccines. Relevant stocks with a 10-fold increase or more since 2019 were BioNTech, Moderna, Arcturus Therapeutics, and Novavax. CureVac started trading with high expectations and lost 90% of its market capitalization since then. Vir Biotechnology produced Covid-19 antibodies, resulting in up to a 5-fold increase in value.

Clearly market capitalization is an important factor. Pfizer stock increased by less than 100% despite the very successful cooperation with BioNTech. However, those gains were much less volatile.

A bird flu pandemic would still be a different from the Covid-19 pandemic. With hundreds of million doses of antivirals like Tamiflu stockpiled and several vaccines ready for production the prospect of an (avian) influenza pandemic may seem less threatening.

However, the effectiveness of existing vaccines is uncertain and the benefits of Tamiflu are moderate. Public perception may be shaped by imprecise media reports about a 50% case fatality ratio and the association with the much more infectious Covid-19. Key factors are indeed how far the CFR can be reduced and how many people will get infected. If local outbreaks can't be contained there will be a strong and urgent demand for the best available medical countermeasures. Those innovative countermeasures may be mRNA vaccines but also newly developed antibodies. Companies developing mRNA vaccines and antibodies with a smaller market capitalization seem to have the most potential. A smaller market capitalization can also make manufacturers of existing antiviral drugs more attractive.

No Pandemic?

What happens if there is no influenza pandemic in the next few years? Unlike insurance premiums, investments in bird flu stocks would probably retain some value or even increase in value.

Influenza will continue to be a burden on humanity in the foreseeable future, infecting billions and killing millions, rapidly evolving. Meanwhile existing pharmaceutical drugs and vaccines have a lot potential for improvement. Development of new medical countermeasures will continue. Stockpiling hundreds of millions of doses will also continue, due to the persistent threat of a new influenza pandemic. State agencies like BARDA will continue to finance influenza pandemic preparedness.

Finally, the companies presented here don't rely solely on influenza countermeasures. The innovative solutions needed to fight rapidly evolving influenza viruses are also used to treat many other diseases, from RSV and malaria to cancer.

Disclaimer

The information provided on this website regarding (avian) influenza stocks is intended for informational purposes only and should not be construed as a recommendation, solicitation, or offer to buy or sell any financial securities. The content on this platform is not intended to provide financial advice or investment guidance. All visitors are strongly advised to conduct their own research and seek professional financial advice before making any investment decisions.

Risk Profile and Financial Situation:

Individuals should be aware that their risk profile and financial situation are unique and may differ significantly from others. The suitability of any investment in stocks related to (avian) influenza is dependent on various personal factors, including financial goals, risk tolerance, and investment objectives. Therefore, it is essential for users to carefully evaluate their circumstances and consult with a qualified financial advisor to determine the appropriateness of investing in such securities.

Risks and Volatility of Biotech Stocks:

Investing in biotech stocks, including those related to (avian) influenza, comes with inherent risks and high volatility. Biotechnology companies often operate in a complex and rapidly evolving industry, which can lead to significant price fluctuations. The value of these stocks may be influenced by factors such as clinical trial outcomes, regulatory approvals, market conditions, and overall performance of the biotech sector.

Failure of Pharmaceutical Studies:

It is crucial to recognize that pharmaceutical studies can fail for various reasons. Despite promising research and development efforts, there is always the possibility of setbacks or unforeseen challenges during clinical trials. As a result, investments in companies conducting (avian) influenza research may be subject to the uncertainties associated with the success or failure of their studies.

(Avian) Influenza Pandemic Uncertainty:

While the topic of an avian influenza pandemic and its potential consequences may be discussed on this website, it is essential to remember that the occurrence of an avian influenza pandemic is uncertain and unpredictable. Market speculation or predictions regarding pandemics should not be taken as factual or definitive indicators of future events.

No Promotion or Endorsement:

The presentation of any stocks on this website does not imply any promotion or endorsement of these securities. The information provided is purely for educational and awareness purposes, and the inclusion of any stocks should not be misconstrued as a recommendation to invest. By using this website, you agree to this disclaimer.